Identifying Third-Party Senders for Financial Institutions

6/10/2020 - By Janice Weisz, AAP

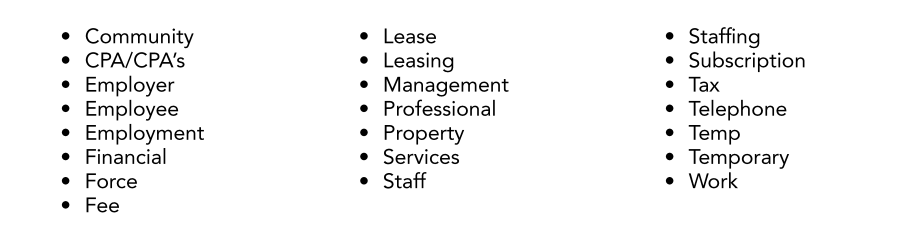

The need to identify and control risk in ACH origination should be a top priority for all Originating Depository Financial Institutions (ODFIs). Identification of third-party senders is a key part of risk discovery. Below are some keywords that can be used to search your database and/or originator files to help identify possible third-party activity. Proactively taking steps to identify and flag third-party senders where they had not been previously associated with a proper grouping, designation, or origination status will give you a starting point to vet and monitor your originating customers.

Make sure to update your list as payments and payment providers evolve.

Questions to Consider if a Match is Found While Searching

- Does the customer process payments (debits or credits) on behalf of other businesses?

- Does the ODFI have an agreement with the other businesses?

- Does your ACH customer have the underlying obligation (e.g., agreement, contract) to pay or be paid by the Receiver?

- Who is the ultimate beneficiary of the transaction?

If third-party senders are discovered, the ODFI needs to consider applying additional risk management measures, including updating the agreement for a third-party relationship, and ensuring that the third party conducts an annual audit as required by the ACH Operating Rules.

HOW WE CAN HELP

Determining whether a customer is acting as a third-party sender can be challenging as you must understand relationships and that appropriate agreements and risk controls are in place and rules are followed. If you have any questions or need assistance, email me at janice.weisz@saltmarshcpa.com or a member of our Financial Institutions Team so we can help you through the entire process or perform an independent review for you.

About the Author | Janice Weisz, AAP

Janice is a consultant in the Financial Institution Advisory Group at Saltmarsh, Cleaveland & Gund. Janice has been working with financial institutions since 2001 with an emphasis on operations, compliance, audit and internal controls. She currently provides ACH compliance, NACHA compliance, internal audit and other consulting services to the firm’s financial institution industry clients.

Related Posts

- Safeguarding Against ACH Fraud: Ten Essential Steps for Financial Institutions and Businesses

- ICYMI: An Important Reminder About the CRA Public File, and More

- Understanding ACH Risk Assessments: A Crucial Requirement of the Nacha Rules

- Nacha's Updated Written Statement of Unauthorized Debit: Should You Update Your WSUD Forms?

- Saltmarsh Hosts 18th Annual BankTalk

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Best Practice Ideas from the Asset-Liability Management Trenches

- Managing Risk: Fraud Deterrence Is Always a Priority

- Webinar on Demand: Getting to Know FedNow, Now

- Nacha's 2023 Rules Updates: Are You Affected?

- Do I Need an ACH Audit?

- Webinar Recording: Top 8 ACH Audit Findings You Should Be Aware Of

- Think CECL Is Only for Banks? Not So Fast!

- Saltmarsh Hosts 17th Annual Community BankTalk Event

- Preparing for $500 Million in Assets

- Secure Exchange of Standardized Letters of Indemnity

- Best Practice Suggestions for Back-Testing Asset-Liability Management (ALM) Models for Accuracy

- Words to Live By

- Webinar Materials: The New ACH Rules on Micro-Entries

- Nacha Micro Entry-Rule

- Elder Financial Exploitation by the Numbers

- CECL: What About Credit Losses on Debt Securities?

- Supplementing Data Security Requirements Rule Phase 2

- Webinar Materials: ODFIs - How Do You Keep Your ACH Clients Informed?

- Webinar Materials: CFO Symposium Update

- View All Articles