Bearish Sentiment

5/1/2025 - By Wes Crill, PhD, Senior Client Solutions Director and Vice President (Dimensional Fund Advisors)

Many investors seem to be pessimistic about the direction of the market. If history is any indicator though, that’s a bad time to get out of stocks.

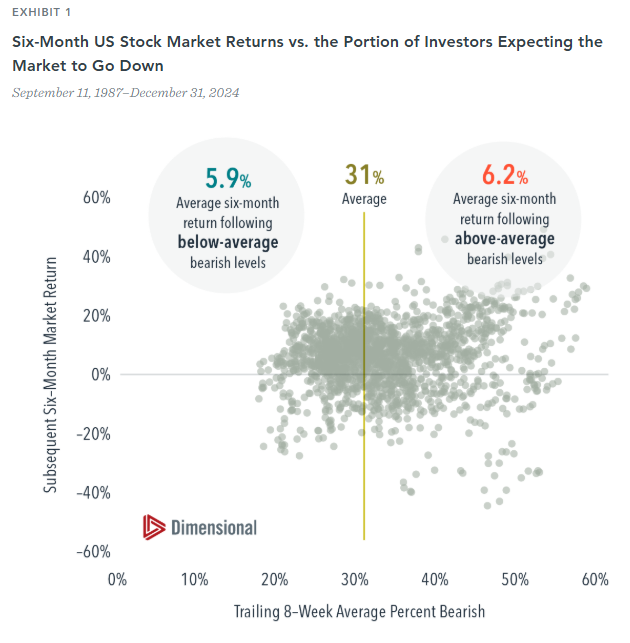

The American Association of Individual Investors polls its 125,000-plus members weekly on their expectations for the stock market over the next six months. The proportion expecting the market to fall is used to form a “bearish” sentiment indicator. As of February 13, the trailing eight-week average bearish percentage was about 37.7%—above the historical average of 31.0% since September 1987 and the highest since November 16, 2023.

Investors should be careful how much trust they put into these glass-half-empty views. Bearish response levels above the historical mean were followed by an average six-month US market return of 6.2%. That’s close to the average return of 5.9% following below-average bearish levels. Overall, there’s little discernable relation between the sentiment indicator and subsequent returns.

Past performance is not a guarantee of future results. Actual returns may be lower.

Related Posts

- Bearish Sentiment

- Tariffs and Stagflation

- How Extreme was Recent Large Growth Outperformance?

- Tariff Trepidation

- Alphabet Soup of Estate Planning

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- Reality Check: Capital Market Assumptions vs. Actual Returns

- The Power of Human Ingenuity

- 2024 Year in Review

- Feeling Generous? Secure Your Own Financial Well-Being First!

- Election Years & Their Impact on the Market: A Data-Driven Perspective

- The Unwinding of the Yen "Carry" Trade

- Preventing Identity Theft: Tips to Protect Yourself & Your Family

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today

- Father's Day: Money Lessons Learned From Dad

- What is Dollar Cost Averaging?

- Cost of Capital: A Gut Check on High-Flying Stock Returns

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- View All Articles