Magnificent 7 Outperformance May Not Continue

2/19/2024 - By Dimensional Fund Advisors

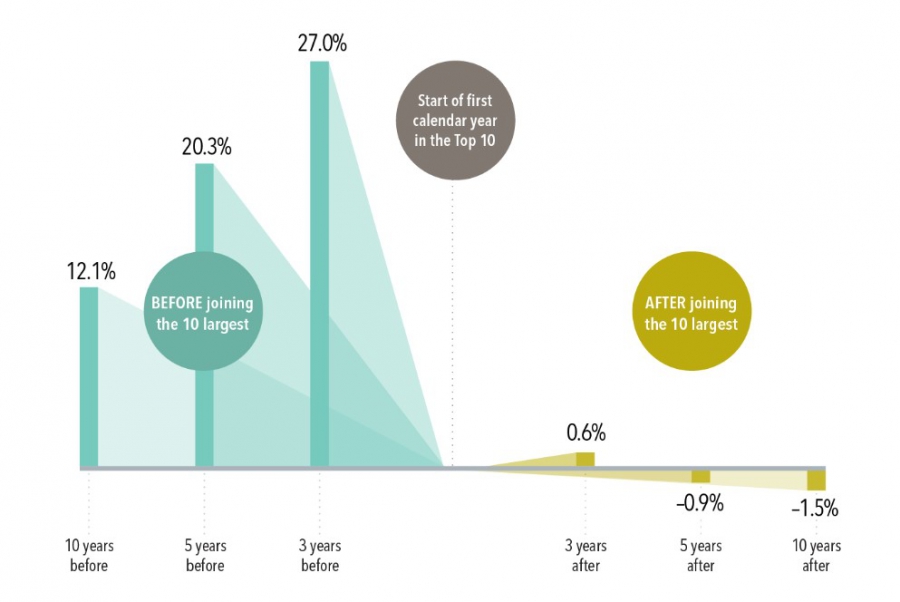

The Magnificent 7 stocks (1) continue to capture the focus of investors as these large growth names have outpaced the bulk of global equities. Their outperformance is notable because eye-popping returns for top stocks tend to occur before they reach the top of the market. Once there, subsequent returns tend to lag the market.

This is a cautionary tale for investors expecting continued outperformance from the Magnificent 7. In fact, rather than seeking additional exposure to these mega cap stocks, investors should ensure their portfolios are broadly diversified to capture the returns of whatever companies ascend to the top in the future.

EXHIBIT 1

View from the Top

Annualized returns in excess of the US market before and after joining the top 10 largest US stocks, January 1927–December 2022

Past performance is not a guarantee of future results

In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalization to identify first-time entrants into the top 10.

The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data.

Indices are not available for direct investment. The index has been included for comparative purposes only.

INDEX DESCRIPTION

Fama/French Total US Market Index: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French’s data library: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Results shown during periods prior to the index inception date do not represent actual returns of the index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

FOOTNOTES

1. The Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Named securities may be held in accounts managed by Dimensional.

Related Posts

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- Dimensional Fixed Income Trading: Price Is Our Priority

- Magnificent 7 Outperformance May Not Continue

- Many Happy Returns

- 2023: A Year In Review

- Fiduciary vs. Suitability Standards: A Personal Reflection

- Investing is a Science, an Art, and a Practice

- The Difference the Right Financial Advisor Makes

- Scary Stories: Imposter Fraud (Webinar On Demand)

- Is a Yield Curve Inversion Bad for Stock Returns?

- How to Build and Improve Your Credit Score

- Navigating a Turbulent Stock Market: A Look at 2009-2019 versus Today

- Register Now: Navigating Turbulent Financial Markets

- 5 Essential Documents for Your Estate Plan

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today for the Third Time

- Taking Care While Giving Care

- Dimensional Wins ETF Issuer of the Year and Best New Active ETF at 2023 ETF.com Awards

- The U.S. Debt Ceiling

- The Stock Market vs. Stocks in the Market

- The Value of Discipline in Value Investing

- The Stuff They Didn't Teach You in School

- View All Articles