No More Free Lunches... Or Rounds of Golf!Meal & Entertainment Expenses under the Tax Cuts & Jobs Act

2/21/2018 - By David Uslan, CPA

The provisions of the Tax Cuts and Jobs Act will impact every individual and business. One of the provisions that has not been widely publicized but will have significant impact is the new rules related to meal and entertainment expenses.

The TCJA completely eliminated an employer’s ability to deduct entertainment expenses paid or incurred after December 31, 2017. The TCJA also significantly limited an employer’s ability to deduct expenses associated with de minimis meals, including meals provided for the convenience of the employer.

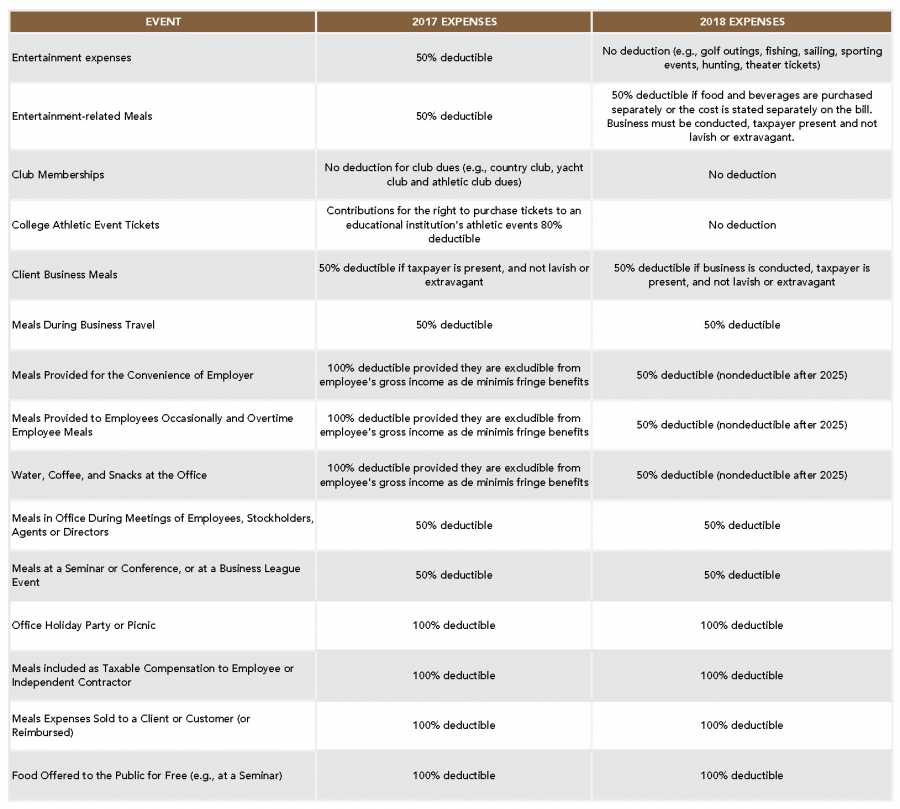

A chart is provided below, to summarize proper treatment for many types of meal and entertainment expenditures, under the law applicable both before and after the TCJA.

Our recommendation is to be more diligent in the classification of meal and entertainment expenses for 2018 and beyond. Since some of these expenses will no longer be deductible, these expenses should be segregated into different accounts for tracking (e.g., 50% meals, 100% meals, and non-deductible entertainment).

Click here to download the complete Meal & Entertainment Expenses under the Tax Cuts & Jobs act flyer. If you have any questions, please contact a Saltmarsh Tax Advisor.

About the Author | David Uslan, CPA

David is a shareholder in the Tax & Accounting Services Department of Saltmarsh, Cleaveland & Gund. He has over 25 years of experience working with growth-oriented companies and business owners in a variety of industries, including manufacturing, software, professional services, real estate, technology, and creative services.

Related Posts

- DOL Audit Requirements: A Critical Reminder for Retirement Plan Sponsors

- Strategies to Reduce Manufacturing Inventory Variances

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Emily Lalas Presenting in Impact 100's Nonprofit Workshop

- Cristine Torrefranca, CPA, Elected Treasurer of Bay Area Manufacturers Association (BAMA)

- Your Action Plan for the CPA Exam

- Webinar Materials: Rethinking Financial Reporting - Nonprofit Strategy

- And That's A Wrap: Manufacturing Month 2021

- Webinar Materials: New Lease Standards for Non-Public Entities

- Reingruber Alert: The 2021 Single Audit Compliance Supplement is here!

- Reingruber Alert: PRF Single Audit Timelines Extended!

- Five Metrics Your Construction Company Should Start Tracking Today

- Provider Relief Funds - Reporting and Audit Requirements

- IRS Extends Certain Tax Filing and Payment Deadlines to May 17

- New IRS Guidance Regarding Tax Due Date Change 2021

- WEBINAR MATERIALS: Understanding Single Audit Requirements for the Healthcare Industry

- Impact of COVID-19 on Accounting Operations Part 2: Positioning Towards the Future

- Impact of COVID on Accounting Operations Part 1: Immediate Actions to Take

- WEBINAR MATERIALS: Strategies for Maximizing PPP Loan Forgiveness, Part IV

- What Plan Sponsors Need to Know About Layoffs and Partial Plan Terminations

- WEBINAR MATERIALS: Strategies for Maximizing PPP Loan Forgiveness, Part III

- COVID-19 is Accelerating the Rise of the Digital Economy

- WEBINAR MATERIALS: How COVID-19 is Impacting Retirement Planning

- Nonprofits and COVID-19: What is Your Strategy?

- New Federal Reserve Guidance For The Main Street Lending Program

- View All Articles