A Disciplined Investment Strategy

2/28/2022 - By Chris Stennett, CFP

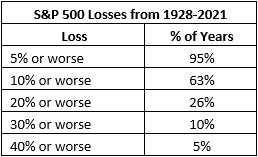

It’s important to have a disciplined investment strategy in place when investing. Reacting to short-term market swings by making dramatic portfolio changes will inevitably lead to a more stressful investing experience. Looking at the S&P 500 dating back to 1928, we see that 95% of all years had at least a 5% loss at some point in that year.

63% of all years will see a 10% or worse loss, yet the S&P 500 has finished with positive returns two out of every three years on average. While bear markets and market crashes are less common (every seven and 12 years respectively), investors should still expect to live through multiple variations of each in their remaining lifetime. Rather than letting market movements dictate your investment strategy, consider using a strategy that considers the frequency of these market movements when constructing your portfolio.

For more information, read this blog by Mark Hemby, CFA about market volatility.

Questions?

If you’re looking for some guidance and would like to speak with one of our Financial Advisors, contact us here.

Related Posts

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- Dimensional Fixed Income Trading: Price Is Our Priority

- Magnificent 7 Outperformance May Not Continue

- Many Happy Returns

- 2023: A Year In Review

- Fiduciary vs. Suitability Standards: A Personal Reflection

- Investing is a Science, an Art, and a Practice

- The Difference the Right Financial Advisor Makes

- Scary Stories: Imposter Fraud (Webinar On Demand)

- Is a Yield Curve Inversion Bad for Stock Returns?

- How to Build and Improve Your Credit Score

- Navigating a Turbulent Stock Market: A Look at 2009-2019 versus Today

- Register Now: Navigating Turbulent Financial Markets

- 5 Essential Documents for Your Estate Plan

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today for the Third Time

- Taking Care While Giving Care

- Dimensional Wins ETF Issuer of the Year and Best New Active ETF at 2023 ETF.com Awards

- The U.S. Debt Ceiling

- The Stock Market vs. Stocks in the Market

- The Value of Discipline in Value Investing

- The Stuff They Didn't Teach You in School

- View All Articles