Exhausted Your Cares Act Paycheck Protection Program Options? Main Street Lending Can Provide Additional Liquidity

5/3/2020 - By Saltmarsh, Cleaveland & Gund

One of the most highly publicized relief options in the Coronavirus Aid, Relief, and Economic Security (CARES) Act that small businesses and sole proprietors have benefitted from is the Paycheck Protection Program (PPP). The PPP authorized $349 billion to be disbursed via federally guaranteed loans administered by the Small Business Administration (SBA). Generally, eligible borrowers can receive 2.5x their 2019 average monthly payroll costs to help retain workers, maintain payroll and cover certain other existing overhead costs amid the pandemic. As a direct incentive to keep workers employed, all or a portion of the loan may be forgiven if the borrower uses the loan for payroll, rent, mortgage interest or utilities for an eight-week period after the loan is received.

However, many businesses have not been able to qualify under the PPP because of, among other things, affiliation restrictions and employee headcount size. Others were not been able to file a PPP application or get approval prior to the funds being depleted. Indeed, on April 16, the SBA announced that the entire $349 billion of initial PPP funding had been exhausted. (On April 24, President Trump signed into a law a bill which provides an additional $310 billion for the PPP, plus $12 billion for administrative costs for the program.)

Even for small businesses that have been (or will be) granted loans under the PPP, it is likely that many will still face major liquidity challenges after eight weeks. The unfortunate reality leaves businesses looking for other potential avenues for cash to stabilize, maintain or continue operations. Fortunately, there are other options available.

Relief Beyond the PPP: $500 Billion Coronavirus Economic Stabilization Plan

Small and medium-sized businesses should be aware that other programs exist under the CARES Act to provide much-needed liquidity in lieu of, or in addition to, relief under the PPP. In particular, Title IV authorizes the Secretary of the Treasury to make loans, loan guarantees and other investments of up to $500 billion to eligible businesses operating in severely distressed sectors of the economy. $46 billion is earmarked for air carriers and businesses critical to national security. The remaining $454 billion is available to lend to other businesses via various loan programs established by the Treasury or Federal Reserve.

Main Street Lending Program (MSLP)

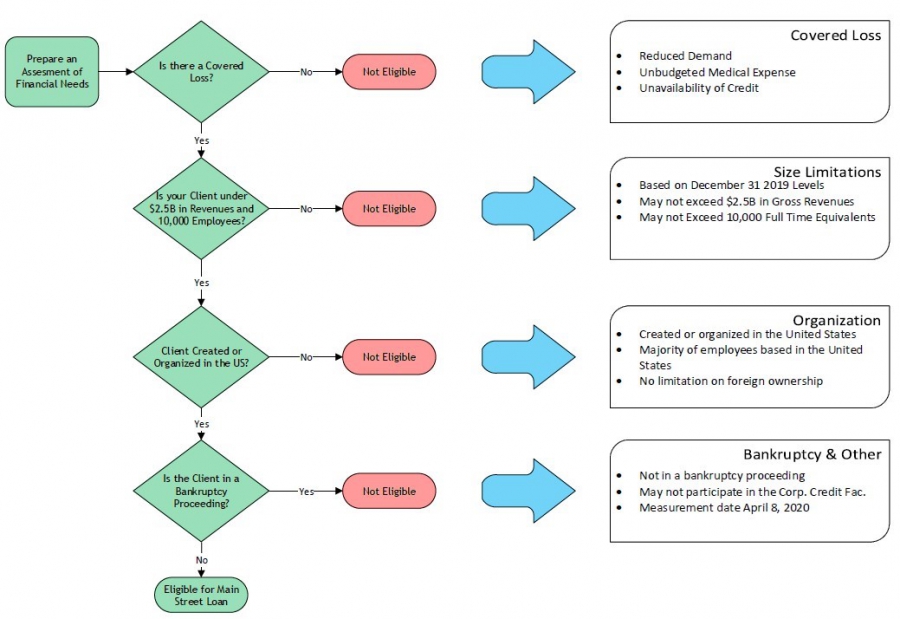

The Federal Reserve created the Main Street Lending Program, whereby the Treasury will carve out $75 billion of the available $454 billion under Title IV to make an equity investment in a special purpose vehicle (SPV), which will enable the flow of credit to small and medium-sized businesses that were in good financial standing prior to the COVID-19 crisis. Businesses can refer to the flowchart below to assist in determining eligibility:

FAQ

Below are frequently asked questions regarding the MSLP and how eligible businesses may be able to take advantage of the program.

Q: If a small business is participating in the PPP, is it also eligible to participate in the MSLP?

A: Yes. A borrower who has applied for or received a loan under the PPP may receive a loan under the MSLP, assuming the borrower meets the eligibility criteria outlined by the Federal Reserve (discussed below).

Q: What loan facilities are available under the MSLP?

A: There are two. The Main Street New Loan Facility (MSNLF) is directed at facilitating new loans, and the Main Street Expanded Loan Facility (MSELF) is focused on expanding existing loans to businesses.

Q: Can borrowers obtain a loan under both MSNLF and MSELF?

A: No. Borrowers can only obtain a loan from one facility.

Q: Can borrowers participate in other Title IV programs if they participate in the MSELF or MSNLF?

A: No. Although the borrower can stack the PPP with the Main Street Programs, the same consideration is not offered for the five other Title IV programs.

Q: What are the specific eligibility criteria?

A: A prospective borrower must meet each of the following criteria:

- Be a business that can demonstrate a need for financing due to the COVID-19 pandemic;

- Employ up to 10,000 employees or had 2019 annual revenues of $2.5 billion or less;

- Created or organized in the U.S. with a significant portion of its operations and employees based in the U.S.; and

- Been in good financial standing prior the COVID-19 pandemic (i.e., not in a bankruptcy proceeding).

Q: Can companies with less than 500 employees qualify (i.e., those that applied for the PPP)?

A: Based on the guidance that the Federal Reserve has issued, a PPP loan is “stackable” with other loan facilities, which suggests that eligible businesses will not have to adhere to the minimal guidance as discussed in §4003(c)(3)(D) of the CARES Act (Assistance for Mid-Sized Businesses).

Q: Are there any affiliation restrictions/requirements similar to the PPP?

A: There is currently no requirement that certain affiliates be included when determining the size limits. However, it is possible the Federal Reserve may provide additional guidance on affiliation rules in the future.

Q: Can a U.S. subsidiary of a foreign company be eligible under the MSLP?

A: The Federal Reserve has not explicitly excluded a U.S. subsidiary of a foreign company from the program, so long as the entity is organized under the laws of the U.S. and the majority of its employees are based in the U.S.

Q: Are MSLP loans potentially forgivable similar to those issued under the PPP?

A: No. Loans made as part of the MSLP are not forgivable. However, there is no pre-payment penalty.

Q: How much of a loan is a borrower eligible for?

A: For businesses seeking loans under MSNLF:

- The minimum loan amount is $1 million, and the maximum size is the smaller of either (1) $25 million or (2) the loan amount, when added to the eligible borrower’s existing undrawn debt, does not exceed 4x the borrower’s 2019 EBITDA.

For businesses seeking an expansion of loans under MSELF:

- The maximum amount of loan expansion is the lower of (1) $150 million, (2) 30% of the eligible borrower’s existing outstanding and committed but undrawn bank debt or (3) the loan amount, when added to the eligible borrower’s existing undrawn debt, does not exceed 6x the borrower’s 2019 EBITDA.

Q: When does the program start/end?

A: The Federal Reserve has not yet stated when the program will begin. Guidance from the Federal Reserve is still evolving, and once it is complete the program will be initiated. The SPV is scheduled to stop purchasing loans on September 30, 2020.

Q: Who will be responsible for making the loans?

A: Loans are made by eligible banks, not by the Treasury or Federal Reserve. The SPV will purchase 95% of the loans at par value, and eligible lenders will retain 5%, which will be subject to Federal Reserve oversight.

Q: Is there a repayment deferment period?

A: Yes. Principal and interest payments are deferred for one year. However, it is anticipated that interest will still accrue at loan inception and be capitalized into the loan balance once the amortization period starts.

Q: Can an eligible borrower use any portion of the loan proceeds to pay off existing debt?

A: No. Eligible borrowers cannot use loan proceeds to repay other loan balances or other debt of equal or lower priority unless the eligible borrower has repaid the eligible loan in full.

Q: Are there any restrictions on stock repurchases during the term of the loan?

A: Yes. For the period starting when the loan proceeds are received and ending 12 months after the loan is paid in full, a borrower cannot make stock repurchases if the securities are listed on a national securities exchange, except as required under a contractual obligation in effect as of March 27, 2020.

Q: Are there any restrictions on employee compensation during the term of the loan?

A: Yes. For the period starting when the loan proceeds are received and ending 12 months after the loan is paid in full, total compensation for certain highly compensated employees is restricted as follows:

- For employees whose 2019 total compensation exceeded $425,000, he/she cannot receive (1) more than his/her total 2019 compensation (for any consecutive 12-month period) or (2) severance/termination pay greater than 2x 2019 compensation.

- For employees whose 2019 total compensation exceeded $3 million, he/she cannot receive (for any consecutive 12-month period) total compensation greater than $3 million plus 50% of his/her 2019 total compensation in excess of $3 million.

Q: Will the eligible borrower be required to collateralize the loan?

A: MSNLF loans will be unsecured. MSELF loans may be secured or unsecured (with any collateral to secure the SPV’s participation on a pro rata basis).

Q: Will the MSELF loan be subordinate to existing debt?

A: No. MSELF loans will be issued on a pari passu basis.

Q: What interest rate will be charged to borrowers?

A: An adjustable rate of the secured overnight financing rate (SOFR) plus 250-400 basis points will be charged. The use of this sliding scale of 250-400 basis points is based on the company’s individual risk profile.

Q: What is the term of the loans?

A: Loans will have a four-year maturity.

Q: Are there any restrictions on reducing employee headcount or payroll when accepting a MSLP loan?

A: Borrowers must make “reasonable efforts” to maintain payroll and retain its employees during the term of the loan.

Q: Will private equity be eligible to participate?

A: The Federal Reserve has not explicitly excluded private equity and other venture-backed businesses from being able to participate, so long as the other eligibility requirements are satisfied. However, the Federal Reserve may release additional details of the program, including affiliation rules as seen in the PPP, which could change eligibility.

Q: Can businesses which are in bankruptcy proceedings be eligible for loans under the MSLP?

A: No. Eligible businesses cannot be in bankruptcy proceedings to participate.

Q: Are there any fees that borrowers will be responsible for?

A: Yes. Borrowers must pay 100 basis points of the principal amount of the loan to the lender as an origination fee.

Q: Has the Federal Reserve provided a loan application for eligible businesses to begin applying?

A: The Federal Reserve has not yet released loan application details. We anticipate additional guidance will be forthcoming shortly.

Insight

The MSLP is an option to provide additional critical liquidity to businesses affected by the current health crisis. The additional liquidity is above and beyond the short-term eight-week relief which they may have received under the PPP. Affected businesses should begin forecasting anticipated cashflow needs over an extended horizon. Effective forecasting will position impacted companies to determine how to meet those needs by leveraging available relief from MSLP.

Businesses which may qualify for both MSNLF and MSELF should take into account a variety of factors to select the facility that is best aligned with their operational strategy and risk profile. In particular, they should consider, among other things, the loan amount they would qualify for under each facility and whether or not they can (or would be willing to) provide any requisite collateral under the MSELF. Further, businesses need to pay close attention to the required attestations and covenants/restrictions to make sure they are able to stay in compliance. Finally, existing lenders may have to approve the acceptance of additional obligations.

As discussed above, there are certain employee compensation restrictions that must be adhered to during the loan period. Businesses should review employment agreements with highly compensated employees to make sure that these restrictions are not in conflict with those agreements. If conflicts exist, businesses will have to potentially seek waivers or execute amendments/modifications to avoid potential breaches.

We anticipate additional guidance and details regarding the MSLP from the Federal Reserve will be forthcoming in the near future. As such, it will be important to continuously monitor the Federal Reserve’s website for the latest information, including application instructions and deadlines given that specific application procedures and requirements are still evolving.

QUESTIONS?

If you have specific questions, please reach out to your engagement shareholder, manager or another member of our team. General questions and inquiries can be directed to Jayme Terrell.

Visit our COVID-19 RESOURCE HUB for ongoing updates and information. Due to the ever-changing nature of this event, you should always consult a professional.

Related Posts

- DOL Audit Requirements: A Critical Reminder for Retirement Plan Sponsors

- Strategies to Reduce Manufacturing Inventory Variances

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Emily Lalas Presenting in Impact 100's Nonprofit Workshop

- Cristine Torrefranca, CPA, Elected Treasurer of Bay Area Manufacturers Association (BAMA)

- Your Action Plan for the CPA Exam

- Webinar Materials: Rethinking Financial Reporting - Nonprofit Strategy

- And That's A Wrap: Manufacturing Month 2021

- Webinar Materials: New Lease Standards for Non-Public Entities

- Reingruber Alert: The 2021 Single Audit Compliance Supplement is here!

- Reingruber Alert: PRF Single Audit Timelines Extended!

- Five Metrics Your Construction Company Should Start Tracking Today

- Provider Relief Funds - Reporting and Audit Requirements

- IRS Extends Certain Tax Filing and Payment Deadlines to May 17

- New IRS Guidance Regarding Tax Due Date Change 2021

- WEBINAR MATERIALS: Understanding Single Audit Requirements for the Healthcare Industry

- Impact of COVID-19 on Accounting Operations Part 2: Positioning Towards the Future

- Impact of COVID on Accounting Operations Part 1: Immediate Actions to Take

- WEBINAR MATERIALS: Strategies for Maximizing PPP Loan Forgiveness, Part IV

- What Plan Sponsors Need to Know About Layoffs and Partial Plan Terminations

- WEBINAR MATERIALS: Strategies for Maximizing PPP Loan Forgiveness, Part III

- COVID-19 is Accelerating the Rise of the Digital Economy

- WEBINAR MATERIALS: How COVID-19 is Impacting Retirement Planning

- Nonprofits and COVID-19: What is Your Strategy?

- New Federal Reserve Guidance For The Main Street Lending Program

- View All Articles