Think CECL Is Only for Banks? Not So Fast!

10/27/2022 - By Joshua Jackson, CPA

In my previous article about CECL (Current Expected Credit Losses), I discussed how the new guidance on credit losses impacts securities portfolios. That article was directed at community banks, but the reality is that many organizations outside of the financial institution's industry also have investments in debt securities and are therefore subject to CECL. As we’ve previously noted, most of the CECL-related focus has been on loans receivable, and to a lesser extent, debt securities. Are there any other financial assets that fall under the CECL guidance? The answer might surprise you.

What’s In, What’s Out?

You might be surprised to learn that the CECL guidance under ASC 326-20 applies to all entities. Specific financial assets that fall within the scope of CECL, as outlined in ASC 326-20-15-2, include financial instruments such as loans receivable, held-to-maturity debt securities, trade receivables, net investments in leases and certain off-balance-sheet credit exposures.

Financial assets not subject to CECL are outlined under ASC 326-20-15-3 and include available-for-sale securities, equity securities and pledge receivables of not-for-profit entities, among other instruments.

Trade Receivables

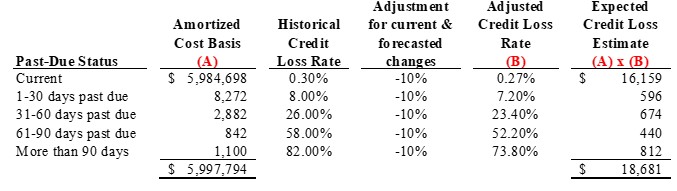

Perhaps the most common in-scope area for non-bank entities is trade receivables. Under the CECL guidance, an entity’s estimate of credit losses on trade receivables must now incorporate forward-looking analysis, which requires the utilization of reasonable and supportable forecasts of future conditions that are expected to impact collectability. The following example illustrates one way an entity may estimate expected credit losses on trade receivables under CECL using an aging schedule:

XYZ Corp. manufactures and sells products to a broad range of customers, primarily retail stores. Customers are typically provided with payment terms of 90 days with a 2%discount if payments are received within 60 days. XYZ Corp. has tracked historical loss information for its trade receivables and compiled the following historical credit loss percentages:

- 0.3%for receivables that are current

- 8%for receivables that are 1–30 days past due

- 26%for receivables that are 31–60 days past due

- 58%for receivables that are 61–90 days past due

- 82%for receivables that are more than 90 days past due.

XYZ Corp. believes that this historical loss information is a reasonable base on which to determine expected credit losses for trade receivables held at the reporting date because the composition of the trade receivables at the reporting date is consistent with that used in developing the historical credit-loss percentages. This means that the similar risk characteristics of its customers and its lending practices have not changed significantly over time.

However, XYZ Corp. has determined that the current, reasonable and supportable forecasted economic conditions have improved as compared with the economic conditions included in the historical information. Specifically, the corporation has observed that unemployment has decreased as of the current reporting date, and XYZ Corp. expects there will be an additional decrease in unemployment over the next year. To adjust the historical loss rates to reflect the effects of those differences in current conditions and forecasted changes, the corporation estimates the loss rate to decrease by approximately 10%in each age bucket. XYZ Corp. developed this estimate based on its knowledge from past experience for which there were similar improvements in the economy.

At the reporting date, XYZ Corp. develops the following aging schedule to estimate expected credit losses.

Implementation Date Rapidly Approaching

For all non-public business entities, the new CECL guidance becomes effective for fiscal years beginning after December 15, 2022. If you are running behind on planning for CECL implementation, please do not hesitate to reach out to our Financial Institution Consulting team! We are here to help.

About the Author | Josh Jackson, CPA

Josh is a senior manager in the Financial Institution Advisory Group of Saltmarsh, Cleaveland & Gund. He has over 18 years of public accounting and financial services experience, primarily serving financial institutions. Josh has extensive experience in delivering accounting services, external audits, directors’ examinations and agreed-upon procedures, loan and credit quality reviews, internal audits, due diligence projects related to mergers and acquisitions, and other consulting services. Prior to rejoining Saltmarsh in 2020, Josh served in various management roles in private industry, including the role of Chief Financial Officer.

Related Posts

- BankChat 2025: Saltmarsh Financial Institutions Takes Nashville

- The Future of ACH Compliance: Insights on Nacha's Latest Rules

- Regulation CC Update Summary

- Saltmarsh Strenghthens Fair Lending Services

- From the Asset-Liability Management Trenches: A Focus on Liquidity 2024

- Unlocking the Power of ACH Compliance Reviews: Requirements and Benefits for Third-Party Senders and Service Providers

- Safeguarding Against ACH Fraud: Ten Essential Steps for Financial Institutions and Businesses

- ICYMI: An Important Reminder About the CRA Public File, and More

- Understanding ACH Risk Assessments: A Crucial Requirement of the Nacha Rules

- Nacha's Updated Written Statement of Unauthorized Debit: Should You Update Your WSUD Forms?

- Saltmarsh Hosts 18th Annual BankTalk

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Best Practice Ideas from the Asset-Liability Management Trenches

- Managing Risk: Fraud Deterrence Is Always a Priority

- Webinar on Demand: Getting to Know FedNow, Now

- Nacha's 2023 Rules Updates: Are You Affected?

- Do I Need an ACH Audit?

- Webinar Recording: Top 8 ACH Audit Findings You Should Be Aware Of

- Think CECL Is Only for Banks? Not So Fast!

- Saltmarsh Hosts 17th Annual Community BankTalk Event

- Preparing for $500 Million in Assets

- Secure Exchange of Standardized Letters of Indemnity

- Best Practice Suggestions for Back-Testing Asset-Liability Management (ALM) Models for Accuracy

- Words to Live By

- Webinar Materials: The New ACH Rules on Micro-Entries

- View All Articles