Inflation and The Federal Reserve

4/25/2022 - By Mark Hemby, CFA

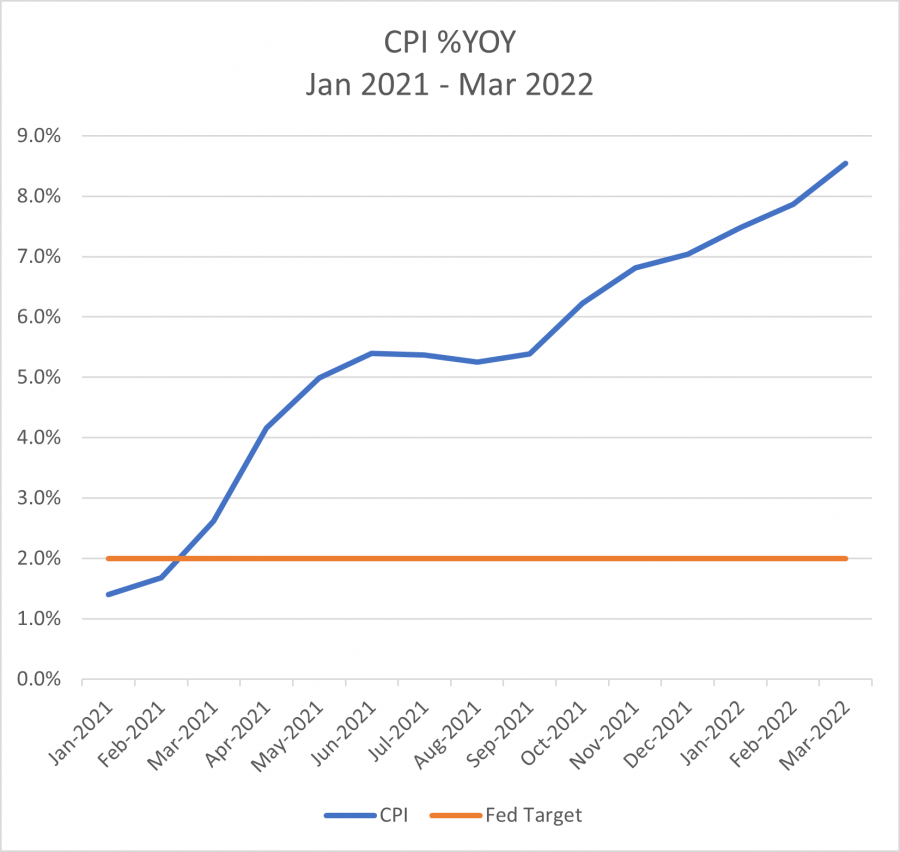

Inflation is one of the most discussed topics in the media and around the water cooler today. The most widely reported measure of inflation is the Consumer Price Index, or CPI. Last month, the CPI increased year over year at an annualized rate of 8.5%. That’s up from 7.9% in February and 7.5% in January. The graph below shows CPI increases over the past 14 months vs. the Federal Reserve’s target inflation rate of 2%:

What is inflation?

The classic economics textbook definition of inflation is “a general increase in prices and fall in the purchasing value of money.” What causes inflation depends on who you ask. The first response is usually too many dollars chasing too few goods. That’s useful but it doesn’t necessarily identify the problem. Is the problem too many dollars, too few goods or a combination of both? Rather than getting into an existential debate of what inflation is, let’s ask a different question: Why does it matter?

Well, for 2 reasons. The first and most obvious answer is that we buy less each month with the money we earn when inflation is high. This especially hurts those who have fixed incomes or incomes that can’t be negotiated higher. A second, less obvious reason is economic miscalculation. To illustrate this idea, imagine you are the CEO of a truck manufacturer. For the past 5 years, you’ve been able to sell your vehicles at higher and higher prices each year. Price is an important signal to management and is often used to forecast future production. A price increase is a signal for management to ramp up production and maximize profits. But how can you tell if the recent increase in prices due to a shortage of trucks due to supply chain issues or an increase in demand due to shifting consumer preferences? If inflation is responsible for even some of the increase in price, your company may manufacture more pickups than it can reasonably sell, increasing the supply of trucks relative to demand and likely decreasing the price your trucks can be sold for. This has a negative impact on the business, which if publicly traded, has a negative impact on the stock market. If enough companies struggle like the truck manufacturer, a ripple effect can negatively impact the stock market and the economy.

Managing Inflation

Too much inflation is a bad thing for most people, so what can be done? Within the U.S. there are two primary types of policies that can be implemented: Fiscal Policy and Monetary Policy. Fiscal Policy is enacted through the government, like changes in tax codes or issuing stimulus checks. While the Federal Government can enact policy to significantly impact the effects of inflation, the prevailing tool to combat inflation is commonly Monetary Policy which is enacted by the United States’ central bank, The Federal Reserve, or The Fed. The Federal Reserve Act of 1913 created the central bank of the U.S. and established a dual mandate to promote maximum employment and stable prices. Since then, their role has expanded to include regulation, interest rate moderation and a host of other functions. As of April 21, 2022, the current unemployment rate of 3.6% is near a historical low and down from a pandemic high of 14.7%. To combat the current inflationary environment The Fed’s primary focus is on stable prices.

The Fed can’t set the prices of goods and services, so how can they impact prices?

Because the Fed is the central bank, they control the supply of money within the U.S. When inflation is high, The Fed looks to “tighten” the money supply. The Fed has several tools at its disposal to accomplish this task, however, the most common tool is the Federal Funds Rate. This is the rate banks charge one another to borrow overnight. Increasing the rate has the effect of decreasing the quantity of money in the banking system thereby lowering or “tightening” the money supply. The most dramatic example of this tool in use was in 1981 when the Federal Reserve raised the Fed Funds Rate to 19%. While this increase caused a recession, this bold move is credited with ending the inflationary cycle of the 1970s and early 1980s. Will the Fed increase the Funds Rate to 19% today? A move that dramatic is doubtful. However, several increases are expected to occur this year.

In the face of this action, what should we do with our investment portfolios?

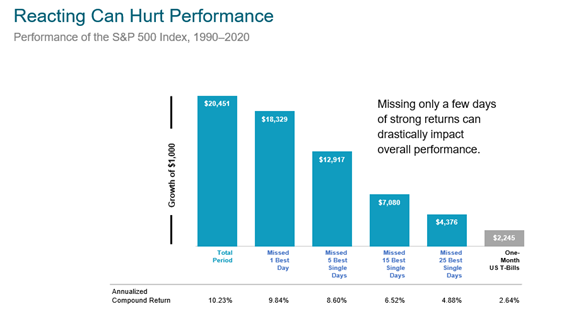

We explored this topic and others in our recent webinar: The Impact of Major Events on Markets Over Time. A key takeaway from our discussion was predicting markets is a precarious endeavor. Often markets move counter to our expectations. The best strategy over a long period of time is to stick with your plan and weather the storm. Market timing requires being correct twice: when to get out and when to get back in. Both decisions have major impacts on returns. Being out of the market for even a few of the best days can have dramatic impacts on your return, as illustrated by the chart above. The most prudent course of action to combat inflation within your portfolio is to have a sound investment strategy in place and stick with it through this adversity.

Questions?

Our Saltmarsh Financial Advisors assist our clients in developing a financial plan that incorporates your risk tolerance and stage of life. Contact us to help you execute a plan and stay disciplined in uncertain times.

About the Author | Mark Hemby, CFA®

Mark is a financial advisor for Saltmarsh Financial Advisors, LLC, an affiliate of Saltmarsh, Cleaveland & Gund. He holds a Chartered Financial Analyst (CFA®) designation and as part of our investment advisory group, he works with clients to develop and implement investment strategies to achieve financial freedom while also ensuring their goals and objectives are aligned. Mark has over 15 years of experience in investment banking working with individuals and organizations to manage their portfolios and coordinate investment activities. In addition to his experience with fixed income trading and sales, Mark owned and operated his own business in Alabama.

Related Posts

- Cost of Index Reconstitution: Index & Diversification Portfolios

- Three Tips for Riding Out the Ups and Downs: Investment Trends

- Bearish Sentiment: Investment Trends

- Tariffs and Stagflation

- How Extreme was Recent Large Growth Outperformance?

- Tariff Trepidation

- Alphabet Soup of Estate Planning

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- Reality Check: Capital Market Assumptions vs. Actual Returns

- The Power of Human Ingenuity

- 2024 Year in Review

- Feeling Generous? Secure Your Own Financial Well-Being First!

- Election Years & Their Impact on the Market: A Data-Driven Perspective

- The Unwinding of the Yen "Carry" Trade

- Preventing Identity Theft: Tips to Protect Yourself & Your Family

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today

- What is Dollar Cost Averaging?

- Cost of Capital: A Gut Check on High-Flying Stock Returns

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- View All Articles