The Sky Is Not Falling... Yet

7/20/2021 - By Joshua Jackson, CPA

The U.S. Bureau of Labor Statistics recently announced the continued upward trend in inflation for June 2021, with the largest month-over-month gain in the consumer price index (CPI) in 13 years. Growth in the year-over-year measure of CPI also accelerated to 5.4%, and people are running around with their hair on fire!

In all fairness, it is an alarming headline - it’s a big number. But when we dig a bit deeper, we quickly see there’s much more to the story.

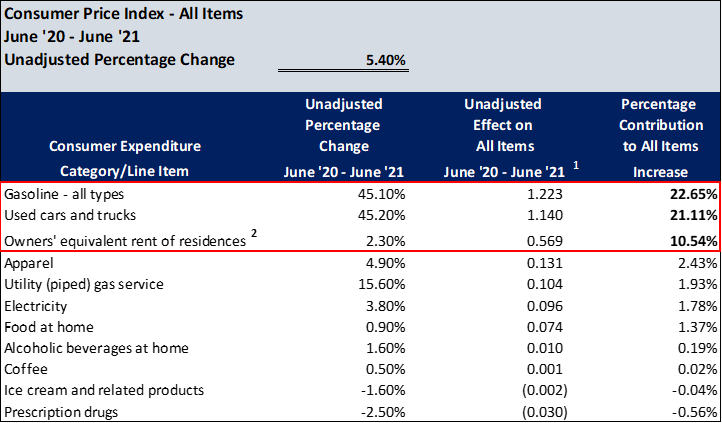

CPI is an average price index computed across a range of economic categories. This means that significant increases to the overall figure can be driven by spikes in just a few economic segments or expenditure items as opposed to a significant “across-the-board” price change for all goods and services. For example, more than 54% of the total CPI increase for the twelve months ended June 2021, was driven by only three expenditure line items, as illustrated in the table below.

Figure 1. Overview of the percentage contribution of select expenditures to the total CPI increase for all goods and services. Unadjusted percentage change and unadjusted effect on All Items for each expenditure were taken directly from the Consumer Price Index – June 2021 report published by the U.S. Department of Labor. This table represents a small portion of consumer expenditure categories.

1 The ‘effect’ of an item category is a measure of that item’s contribution to the All Items price change. For example, as the Used Cars and Trucks index had an effect of 1.140, and the All Items index rose 5.40%, then the increase in used vehicle prices contributed 1.140 / 5.4, or 21.11%, to the All Items increase. In other words, 21.11% of the increase in CPI was driven solely by used vehicles. Effects can be negative as well. For example, the effect of Prescription Drugs was -0.03, which indicates the All Items index actually would have been 0.03 higher (or 0.56%) had prescription prices been unchanged. Since prescription prices fell while prices overall were rising, the contribution of Prescription Drugs to the All Items price change was negative (in this case, -0.03 / 5.4, or -0.56%).

2 The expenditure weight for owners’ equivalent rent of residences is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

As we can see, the largest drivers of the overall increase in CPI are the prices of gasoline and used cars and trucks, both increasing by more than 45% from a year ago. At first glance this is staggering, but when we consider the base year used to track CPI changes, none of this is all that surprising. I don’t know about you, but I wasn’t driving very much in 2020. Like most of the country, I was stuck at home. The resulting decreased demand for gasoline led to an oversupply of crude oil and ultimately a collapse in gasoline prices for most of 2020. Yes, a 45% increase sounds like a lot, but would you believe gas prices in 2021 have not been substantially higher than they were prior to the pandemic? At various times in 2018 and 2019, gas prices peaked at nearly $3/gallon. The average price of gas per gallon is $3.15 as of July 15, 2021, and will likely go higher throughout the summer. However, the most recent projections released by the U.S. Energy Information Administration from July 2021, estimate the average price of gas per gallon will fall to $2.85 and $2.74 for 2021 and 2022, respectively. In other words, the 45% increase in gas prices from a year ago reflects a collapse in prices and a subsequent return to pre-pandemic levels as demand continues to skyrocket in 2021. Nothing to see here, really.

Contributing factors to price increases for used cars and trucks include the global shortage of semiconductors needed to produce new vehicles. Reduced supply of new cars results in higher demand and prices for used cars. This demand is compounded by rental car agencies restocking their inventories after dumping their fleets at the beginning of the pandemic. It should be noted that the severity of current trends in the few categories significantly impacting CPI are expected to be short-term. This is why the Federal Reserve, the "Fed", describes the current rate of inflation as transitory. In truth, the increases in these categories are indicators of economic recovery and large-scale reopening of our communities to business and travel – all good things.

On the other hand, price increases for most other everyday goods and services were far more modest, and for many essential categories, such as food and medical care commodities, the increases were still within the Fed’s target rate of 2%. This is also a positive sign. Even the critically vital segments of alcoholic beverages, coffee, and ice cream did not move much from a year ago, according to the table above (mint chocolate chip is the greatest flavor of ice cream, by the way).

At any rate, the point of all of this is to say that inflation probably is not as problematic right now as the headlines might suggest. The time for real concern may come, but that time has not yet arrived according to most economists. So if you’re finally planning to take that vacation or buy a used car to travel the country after more than a year stuck at home, you can likely expect to pay a bit more. But even at higher prices, these are indications of a return to a well-functioning economy and a normal life.

Questions?

If you have any questions, feel free to reach out to our Financial Institutions team!

About the Author | Joshua Jackson, CPA

Josh is a senior manager in the Financial Institution Advisory Group of Saltmarsh, Cleaveland & Gund. He has over 18 years of public accounting and financial services experience, primarily serving financial institutions. Josh has extensive experience in delivering accounting services, external audits, directors’ examinations and agreed-upon procedures, loan and credit quality reviews, internal audits, due diligence projects related to mergers and acquisitions, and other consulting services. Prior to rejoining Saltmarsh in 2020, Josh served in various management roles in private industry, including the role of Chief Financial Officer.

Related Posts

- Are there State Tax Liabilities for Employers if Employees Work from Home?

- Webinar Materials: Rethinking Financial Reporting - Nonprofit Strategy

- Webinar Materials: New Mortgage Servicing Rules

- Cryptocurrency - It's Time to Acknowledge the Elephant in the Room

- WEBINAR MATERIALS: PRF Reporting Update for Healthcare

- What's New with the Employee Retention Credit: An Overview

- White Paper: Manufacturing Outlook, Lean Thinking to Reduce Costs

- Higher Education in the U.S. - Rising Costs, Enrollment Challenges and the Need for Innovative Solutions

- WEBINAR MATERIALS: Current Update on CARES Act PRF Reporting Instructions & Recent FAQs

- 2021 State & Local Tax Year-End Issues to Consider Now

- The Sky Is Not Falling... Yet

- Cares Act vs American Rescue Plan Act Funding

- GovCon Updates of the Week Part 10

- Covid-19 Implications For Presumptive Laws And Workers' Compensation

- Asset Liability Management Modeling in a COVID-19 World

- Maximizing Value and Minimizing Risk in Your Managed Care Contract Portfolio

- The Excess Liquidity Puzzle

- Finding Flexibility Amid COVID-19: How Nonprofits Can Scale for Success

- White House Unveils Plan to Help American Families Funded by Tax Increases on Wealthy

- Tech Leaders Worldwide Have Optimistic Outlook For 2021

- White Paper: Manufacturing Outlook, Help Wanted

- Employer Tax Credit for Vaccine-Related Sick Leave

- GovCon Updates of the Week Part 5

- IRS Issues Guidance for Claiming Employee Retention Credit in 2021

- Five Metrics Your Construction Company Should Start Tracking Today

- View All Articles